You can reach us anytime via zicklin@zicklincontracting.com

Request a Free Consultation

Check out what our clients say

Why Choose Zicklin Contracting for Damage Claim Services?

Why Choose Zicklin Contracting for Damage Claim Services?

We know that filing an insurance claim can be challenging, especially after something major has taken place, like a storm, fire, or flood. That is why Zicklin Contracting wants to take that headache away and do everything we can to relieve the stress and confusion that inevitably accompanies such an ordeal. Here is why New Yorkers choose us.

Comprehensive Services – Our services include initial damage assessments and documentation, insurance claim negotiations, and, if necessary, full-scale litigation. We handle every step of your claim so you can get your life back to normal.Local Knowledge – As a locally owned and operated business, we are intimately familiar with the unique challenges New York residents face. Our local expertise ensures we can provide personalized and effective solutions tailored to your needs.

Transparent Communication – Because we are a locally owned and operated business, we know all the local issues New York, Queens, and Brooklyn residents face daily. As residents ourselves, we understand your needs and can offer personalized and effective solutions for your circumstances.

Common Types of Insurance Claims We Handle

Unlike other companies that prioritize volume over quality, here at Zicklin Contracting, we focus solely on delivering a client-centric experience. We work closely with you throughout the entire insurance claim process, ensuring not only a full restoration but also proactive measures to prevent future damage.

-

Fire Damage Claims

Fire damage, whether from lightning, a kitchen fire, or a short circuit, can be overwhelming for property owners. At Zicklin Contracting, we thoroughly assess and document the damage, handling every aspect of your insurance claim—from smoke and soot cleanup to structural repairs—while working to expedite the process and restore your property quickly. -

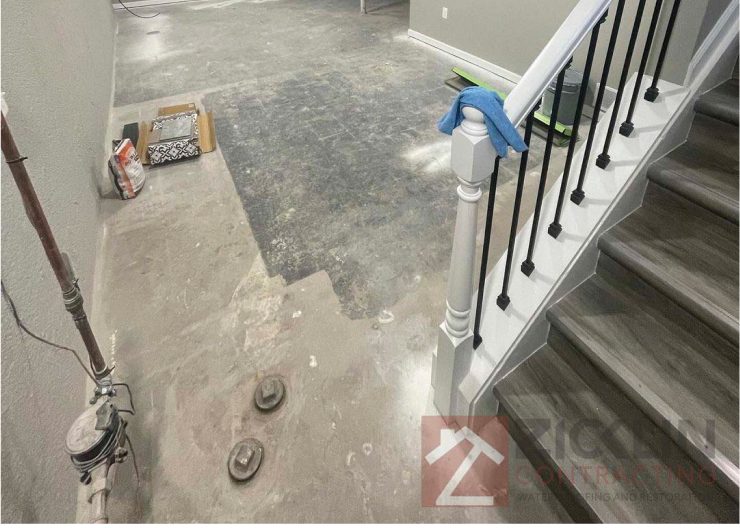

Water Damage Mold Insurance Claim

At Zicklin Contracting, we handle water damage and mold insurance claims from start to finish, ensuring no loose ends. We quickly assess and document the damage, addressing it promptly to prevent mold growth and health risks, while managing your claim efficiently to avoid future issues. -

Basement Flood Insurance Claim

A basement flood can cause significant structural damage and lead to health issues from mold. At Zicklin Contracting, we specialize in handling basement flood insurance claims, documenting the damage, and managing the process from water extraction and mold removal to structural repairs. If you experience a basement flood, call us, and we’ll take care of everything from inspection to final repair. -

Renters Insurance Claim

Renter’s insurance claims often involve theft, fire, or water damage. At Zicklin Contracting, we guide renters through the entire claim process, documenting damages, handling paperwork, and communicating with insurers. Let us manage your water damage claim to ensure full and timely compensation. -

Renters Insurance Claim

Damages from most renter’s insurance claims commonly include theft, fire, or water damage. At Zicklin Contracting, we help renters understand and take advantage of their coverage by handling the entire renter’s insurance claim process. When renters suffer a loss, we document the damages, complete all the paperwork, and communicate directly with the insurance companies. Let us handle your renter’s insurance claims water damage to ensure you are fully compensated promptly.

Ready to work together?

Call To Schedule An Inspection & Get Back To Normal In No Time

Frequently Asked Questions about Insurance Claims

Whether coverage is provided for mold arising out of a plumbing leak depends on the policy wording. Some policies will provide coverage for mold damage arising out of a sudden and accidental pipe leak, while others may exclude coverage for mold remediation.

It is definitely a good idea to report it to your property insurer as soon as you notice the mold. Doing so can help ensure your policy covers the necessary work, and that the company moves expeditiously to assess and mitigate the damage.

While water damage is not a guarantee of mold, it significantly increases the risk for mold contamination if not dealt with. In general, mold can develop within 24-48 hours of water exposure. Therefore, it is important to act quickly and to remove water damage to prevent mold.

You can file a successful water leak claim with your insurance company if you document the damage with photos, report that damage to your insurance company right away, and submit any damage documentation. You can also have your leak repaired and your water extraction done in a timely manner to help your claim.

An example of a renter’s insurance claim might be personal property damaged by a pipe that bursts in the apartment. The claim might be for the cost to replace or repair the renter’s furniture, electronics, clothing and other items.

A standard policy covers the loss of personal property due to fire, theft, vandalism and specific water damage events, in addition to providing liability coverage and payment for additional living expenses if you need to relocate temporarily. You may also file a renter’s insurance claim for mold damage.

When you put in a renter’s insurance claim, your next premium — your current policy’s price at your next renewal — might or might not be higher, depending on the specifics of the claim and the insurance company’s policies.

Five events typically covered by renter’s insurance include fire damage, which protects your belongings in case of a fire; theft of personal property, providing coverage for stolen items; vandalism, offering compensation for damages caused by intentional destruction; water damage from a burst pipe, covering items damaged by unexpected water leaks; and smoke damage, which protects belongings affected by smoke.